do digital nomads have to register their company in their ‘home country’?

Here’s why that isn’t always a good idea.

An increasing number of people can work online from anywhere.

They are often described as ‘digital nomads’ because many of them use that freedom to travel at the same time, but this is part of a much broader trend towards location-independence for everyone. Thanks to the internet and advances in digital technology, more people are able to work flexibly and globally, whether through their own company or as a remote worker.

If you want to start your own company as a digital nomad though, which country do you register it in?

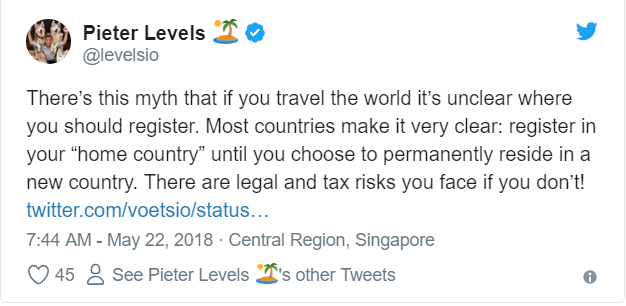

Pieter Levels is the founder of NomadList and one of the most influential voices in the digital nomad community. His advice, which he made clear in a series of tweets yesterday, is: register your company in your ‘home country’.

Here at the e-Residency programme, we have enormous respect for Pieter as someone who is passionate about making the world a better place for digital nomads. We also fundamentally disagree with him on this specific idea though so it’s worth exploring this topic in more detail and then we would love to hear more about people’s thoughts.

Registering a company in your ‘home country’ before going travelling is certainly an option to consider and it may be your best option — but that won’t be the case for everyone. That’s why e-Residency is popular with digital nomads because it provides an option to establish a trusted EU company that can be managed online from anywhere with minimal cost and hassle.

We would love to invite Pieter to Tallinn so he can explore how our digital nation works and we can learn more from him about how to support digital nomads — with everything from e-Residency to the proposed digital nomad visa, which is under development. Just tell us when you can make it, Pieter, and we’ll arrange the rest.

Taxation

I should start off by pointing out that there are two concepts here that shouldn’t be confused: where you register your company and where that company pays its taxes.

Digital nomads have to comply with international tax rules regardless of where the company was registered and regardless of whether or not they are an e-resident. It doesn’t matter if you register your company in Estonia through e-Residency or in your home country, the taxation must be paid where it is owed and that might be neither of those two countries.

Estonia actually has one of the world’s most transparent business environments so key data about Estonian companies, including those established through e-Residency, is publicly available — such as their ownership, revenue and taxation paid. This transparency is actually part of the reason for why Estonia can effectively serve digital nomads.

Dmitri Jegorov is Undersecretary for Tax and Customs Policy at the Estonian Ministry of Finance and a member of the High-Level Working Party on Taxes at the EU Council. He’s been influential in working to achieve a fairer and more transparent tax system internationally.

As he explains:

Our e-Residency program provides many benefits for legitimate entrepreneurs — such as remote management, lower cost of business services, access to the EU market, and access to a wider choice of e-services — but avoiding tax responsibilities is not one of them. In fact, many e-residents make a larger tax contribution to their home country as a result of their increased profitability by using the program.

If a company is established in Estonia through e-Residency, but a second country can fairly claim that the tax is owed to them then that Estonian company will pay its taxes to that second country and not Estonia.

Estonia already has 57 tax agreements in place to ensure that process is smooth. If that second country doesn’t have a tax agreement in place then this process can be more hassle but the principle is the same and Estonia does not collect tax revenue that is not owed to it, because Estonia avoids double taxation also on the basis of its internal law.

It’s an understatement to say that international tax rules are complex, especially for digital nomads, but you can read general advice for e-residents from the Head of the Estonian Tax Board here:

If you have any doubt at all about your personal or company tax obligations then we always say you must speak to a tax adviser about your specific circumstances. In addition, the Estonian Tax Board is happy to answer questions at nonresident@emta.ee.

If you want to understand why Estonia benefits from the programme without requiring e-residents to pay taxes to Estonia then bare in mind that Estonia became a digital nation long before people were even using the term ‘digital nomads’. Estonians have been benefiting from e-governance for a long time so it is only relatively recently that those opportunities were opened up globally through e-Residency. Estonia benefits from the programme because companies established through e-Residency are likely to develop business connections with Estonia. About 90% of e-resident companies use business services from Estonia, such as for their accounting and virtual office, while many others go further and develop even deeper connections with their new digital home. For a small country that has already invested in an advanced digital infrastructure for its citizens and already has a supportive business environment, e-Residency has a significantly positive effect on the Estonian economy — as confirmed by a recent independent analysis from Deloitte.

Just this week, for example, the Indian media has been reporting that the country’s wealthiest person is considering significant investments in Estonia after becoming an e-resident:

It’s not about taxation though

There’s a bigger problem with simply registering a company in your home country though.

It can be a good option if you are retaining ties to that country and the company can be managed remotely with minimal cost and hassle, but that is not the case for the vast majority of people on Earth.

Firstly, it’s a problem for anyone who is planning to change their home country again in future. There’s simply no point going through the hassle of registering your company again every time you change your residency.

Secondly, the barriers to entrepreneurship are dramatically different around the world due to the availability of services and business tools, incorporation costs, bureaucracy, business administration costs, trust, regulations, share capital requirement and — most fundamentally for digital nomads — how easily they can manage the company remotely.

These barriers can be challenging for entrepreneurs who stay in one place so they are even worse for digital nomads. Imagine you are from Ukraine or Turkey, for example, where the availability of services to companies registered locally does not even include PayPal and receiving money internationally is particularly difficult. If you can’t register a trusted location-independent company in your home country then does that mean you are not allowed to be a digital nomad? The media stereotype of a digital nomad is of a relatively privileged young person from the West who is working alongside an exotic beach, usually in east Asia. It’s wrong though to assume that this represents the rise of digital nomads and we shouldn’t give advice only aimed at them.

So is it just people from developing countries who should be given leeway to not register their country in their home country? If so, why are digital nomads from across Europe apply for e-Residency in ever larger numbers?

The growth of the e-Residency community has actually been largely dependent on two factors — where there are the biggest barriers to entrepreneurship and where Estonia currently has the strongest connections. For example, e-residents have to visit an Estonian Embassy to collect their digital ID card and most of our Embassies are in Europe. E-Residency is most popular in Ukraine because there are both high barriers to entrepreneurship and a strong friendship with Estonia.

It is not correct though that anyone from a developed country can easily establish a location-independent company. Even inside the EU, there are huge differences between how countries say a company has to be established and managed. If people stick to their home country then that can mean higher costs and more hassle to digital nomads — or even prevent them from being a digital nomad in the first place.

Let’s use a real example this time.

Ilias Ismanalijev’ home country is Belgium, but it costs around €1,5000 to register a company there, as well as an investment of €16,500 share capital — half of which has to be paid in upfront. In addition, companies registered in Belgium also have to prove they have office space in Belgium. Ilias did not have the capital required and so did not have the ability to become a digital nomad if he registered his company in Belgium.

Ilias instead used NomadList to explore different options and found that e-Residency was the right solution for him because the company meets all his needs, yet can be managed online from anywhere at a significantly lower cost. He paid €100 to become an e-resident (which covers the Police background checks), €190 state fee to register his company, then pays a business services provider based in Estonia for his accounting and virtual office at a more affordable price than is available to him in his home country.

As a result, Ilias now runs Illyism and is living the dream as a digital nomad.

In conclusion

We disagree that digital nomads should register their companies in their ‘home countries’ — if such a thing even exists for them — although they certainly should consider that option.

It will be a good option for many digital nomads and the best option for some of them, but that is far from true for everyone. At best, it can signicantly add to the costs and hassle of being a digital nomad. At worst, it excludes vast numbers of people from ever becoming digital nomads.

The most important thing is that people have the freedom to choose the services they need to run their location-independent companies. That works for choosing private services — like which payment provider or web host to use — so why shouldn’t it work for the public sector too when choosing where to register your company?

There is nothing wrong with being a location-independent entrepreneur with a company in a different country to where you are from, but you must pay your taxes where they are owed. That doesn’t necessarily mean paying them to where the company is registered, regardless of whether you have chosen to register your company in Estonia through e-Residency or in your home country as Pieter suggests.

This debate will, no doubt, continue and that’s a good thing.

The digital nomad community has always been incredibly helpful to each other when it comes to figuring out the best solutions to challenges facing digital nomads — thanks to people like Pieter who developed NomadList for them. There is still a long way to go to make life easier for digital nomads — especially when it comes to issues like visas and taxation — but governments and companies can work together with digital nomads to improve these issues.

In Estonia, our digital door is open.

More from e-Residency

- Sign up for our newsletter

- Watch fresh video content - subscribe to our Youtube channel

- Meet our team and e-residents - register for our next Live Q&A