transfer pricing regulations: a short guide for e-residents

An introduction to transfer pricing regulations for cross-border corporate groups

What are Transfer Pricing Regulations?

Transfer Pricing Regulations mean that if you own more than one company and they do business with each other, your companies should interact as if they were owned by different owners and charge each other for services at a ‘Market Rate'.

Transfer Pricing Regulations are a complex subject. Based on the guidelines set out by the Organisation for Economic Co-operation and Development (OECD), most countries have regulations in place to ensure companies pay their fair share of tax, in the country where their company group is creating value.

This may already sound complicated, but in this blog post, I hope to explain the fundamentals of Transfer Pricing, show you how they might apply to your Estonian business, and why it is advisable to put an Intra-Company Service Agreement in place.

5 step guide to Transfer Pricing Regulations:

- When do Transfer Pricing Regulations apply?

- How does Transfer Pricing work?

- What are the reporting requirements for Transfer Pricing?

- Why is Transfer Pricing important?

- What to do next?

Not yet an e-resident or an Estonian business owner and need more information on the easiest way to set up a company in Europe and run it fully remotely? Find out here:

1. When do Transfer Pricing Regulations Apply?

Transfer Pricing affects those who run two or more companies that have contractual relations with each other and are classified as ‘Related Parties’. Simply put, if you own more than one company and they do business with each other they may need an Intra-Company Service Agreement in place.

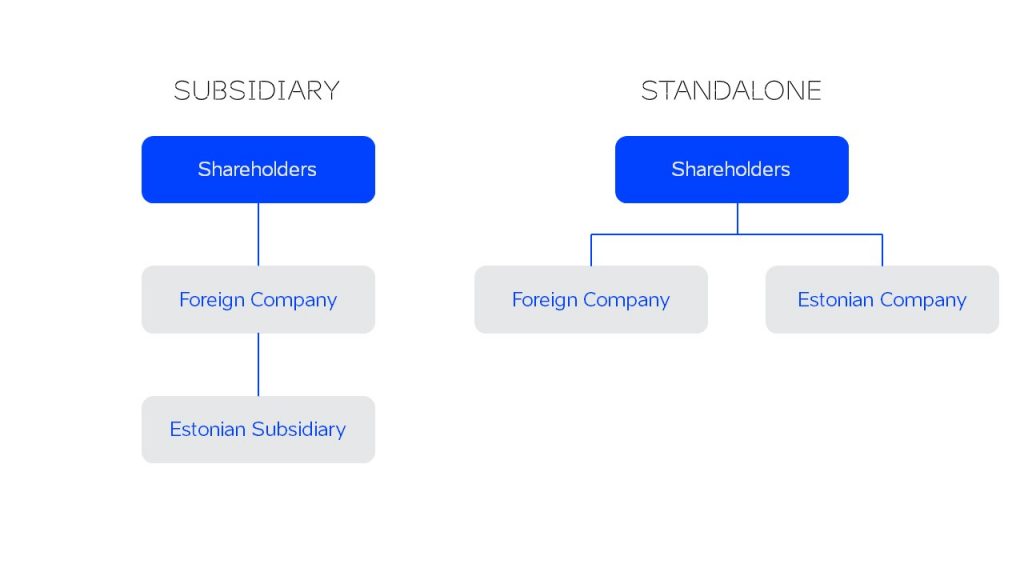

The legal definition for ‘Related Parties’ is normally for companies that have the same ‘Ultimate Beneficial Owners’. This means even if you are not the direct owner of the company but you are the ultimate owner of the owners of that company, both companies will be classified as Related Parties for Transfer Pricing Regulation purposes. Have a look at the diagram below:

As you can see we have two examples of company ownership, a Subsidiary model and a Standalone model. In both cases, though ownership of the Estonian company might be direct to the shareholders or via a subsidiary, the Ultimate Beneficial Owners remain the same.

The term ‘Related Party’ for Transfer Pricing purposes is defined differently in different countries. This is something to look into if the companies you run do not have the same shareholder structures, but if the owners are the same or just one person, for the majority of cases the same definition will apply. You can find the Estonian definition here (translated to English as ‘Associated Persons’ rather than ‘Related Parties’).

2. How does Transfer Pricing work?

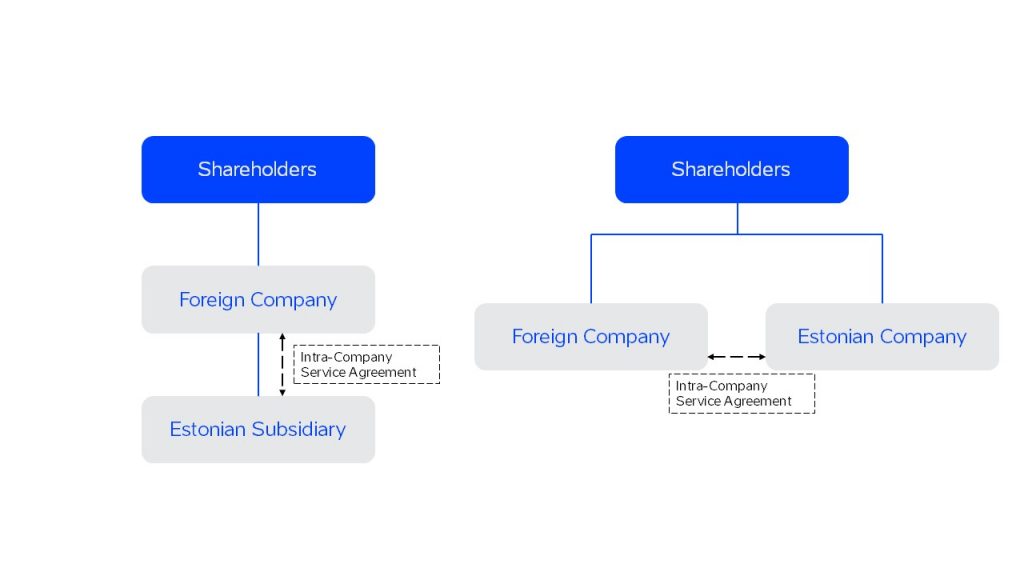

Once you have established that Transfer Pricing applies to your companies, you need to take steps so that they operate on an ‘Arms Length Principle'. This means your companies should interact as if they were owned by different owners and charge each other for services at a ‘Market Rate’. This is most commonly done through an Intra-Company Service Agreement.

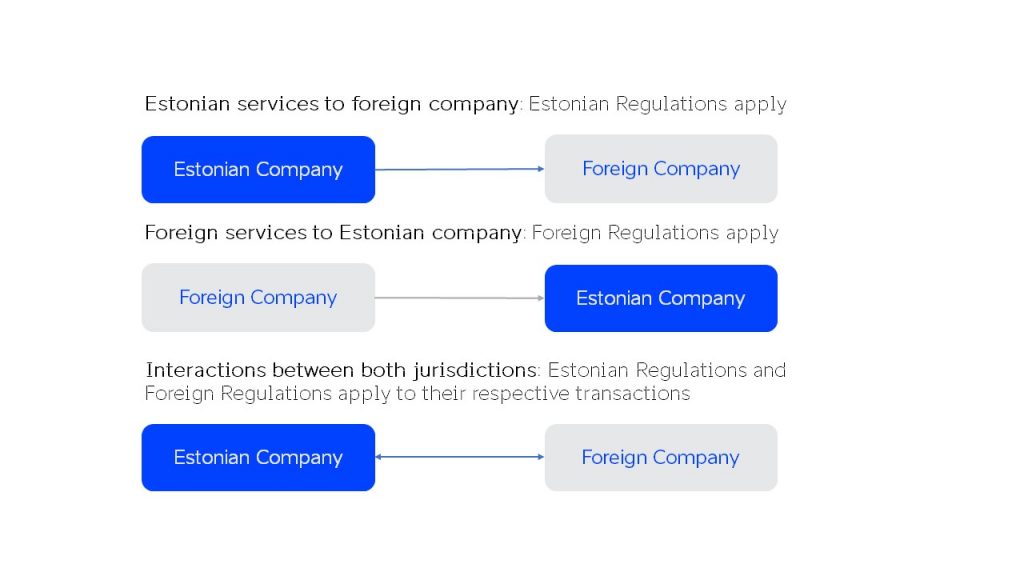

Before going further it is important to highlight that you may need to look into the Transfer Pricing Regulations of more than one country depending on how your entities interact. If your companies are only interacting in one direction then only one set of Transfer Pricing regulations apply, but if it is to and from different companies you will need to apply two different sets of rules.

Example of Transfer Pricing

It is common for most Related Parties to have a two-way relationship. For example; a Spanish company sets up a logistics company in Estonia, to purchase local produce and transport it to its markets in Spain. The Estonian company will charge the Spanish company for the purchasing of products and logistical services. The owners and directors of both companies are the same. However, as the working Directors live in Spain they charge the Estonian company for the management costs of running that company via the Spanish company. These two different interactions are priced at the Market Rate adhering to the Arms Length Principle, as neither service would normally be offered to a third party for free.

Pricing in an Intra-Company Service Agreement can normally be calculated either by ‘Benchmarking’ or by using a ‘Cost-Plus’ model. Benchmarking is when you get an accredited third party (normally an accountant) to benchmark your company services to the industry average, effectively giving you a price list on what you should charge between your Related Parties.

A Cost-Plus model is when you charge companies the cost of providing a service, plus a markup of 5-15% depending on the nature of the service. This is the more preferred model for companies as it means you are not restricted to a predetermined set of services and can calculate costs competitively. This model works very well when one of your companies provides their services exclusively to the other, as the cost of providing that service is the total running costs of the company, plus a 5-10% markup.

Though Estonian legislation sets out the mechanism for Cost-Plus models, it is advisable to seek the advice of an Estonia accountant on what exact mark-up percentage applies to your business.

3. What are the reporting requirements for Transfer Pricing?

In Estonia, SMEs are not required to hold any official Transfer Pricing documentation unless they have over €50 million annual sales, a €43 million balance sheet, or over 250 employees. However, regardless of size, the Estonian Tax Office has the right to demand from any company dealing with Related Parties, evidence they have adhered to the Arms Length Principle.

This evidence is most commonly provided through an operating Intra-Company Service Agreement, which both documents your companies adherence to the Arms Length Principle and also helps you calculate the prices you should charge between your Related Parties.

4. Why is Transfer Pricing important?

Though for small companies the formalities required are not excessive and can be met by a robust Intra-Company Service Agreement, the risk of not putting an agreement in place is substantial.

The Estonian Tax Office can demand to see your Transfer Pricing Documentation and its supporting evidence. Though you may not be required to submit Estonian documentation annually for Transfer Pricing, as detailed previously, if you cannot show that you have adhered to the Arms Length Principle the Tax Office may retrospectively value your intra-company dealings. This may lead to them evaluating these transactions and appling income tax (normally 20%) to the difference between the rate charged and what it sees as the Market Rate. This will be in addition to the 0.06% interest per day calculated from the following day the tax obligation became due. This can be a large liability if you have been trading for several years and all your transactions are penalized simultaneously.

Find additional resources on this topic in relation to Estonia here by PriceWaterhouseCoopers and from the OECD here.

5. What to do next?

If Transfer Pricing does apply to you - that is, you are the UBO of one more companies in other countries in addition to your Estonian company - then the best thing to do is put an Intra-Company Service Agreement in place and figure out the formulae to calculate the costs for your services between the Related Parties you operate.

If you’re looking for help with either the legal or financial aspects of this head over to the e-Residency Marketplace where our service providers can help you out.

Author

Alan Page-Duffy is a freelance writer for e-Residency. He specialises in UK/Estonian Business Operations and runs his own consultancy Cognito Support which supports businesses that operate in both Estonia and the UK.