Example: No fixed place of business

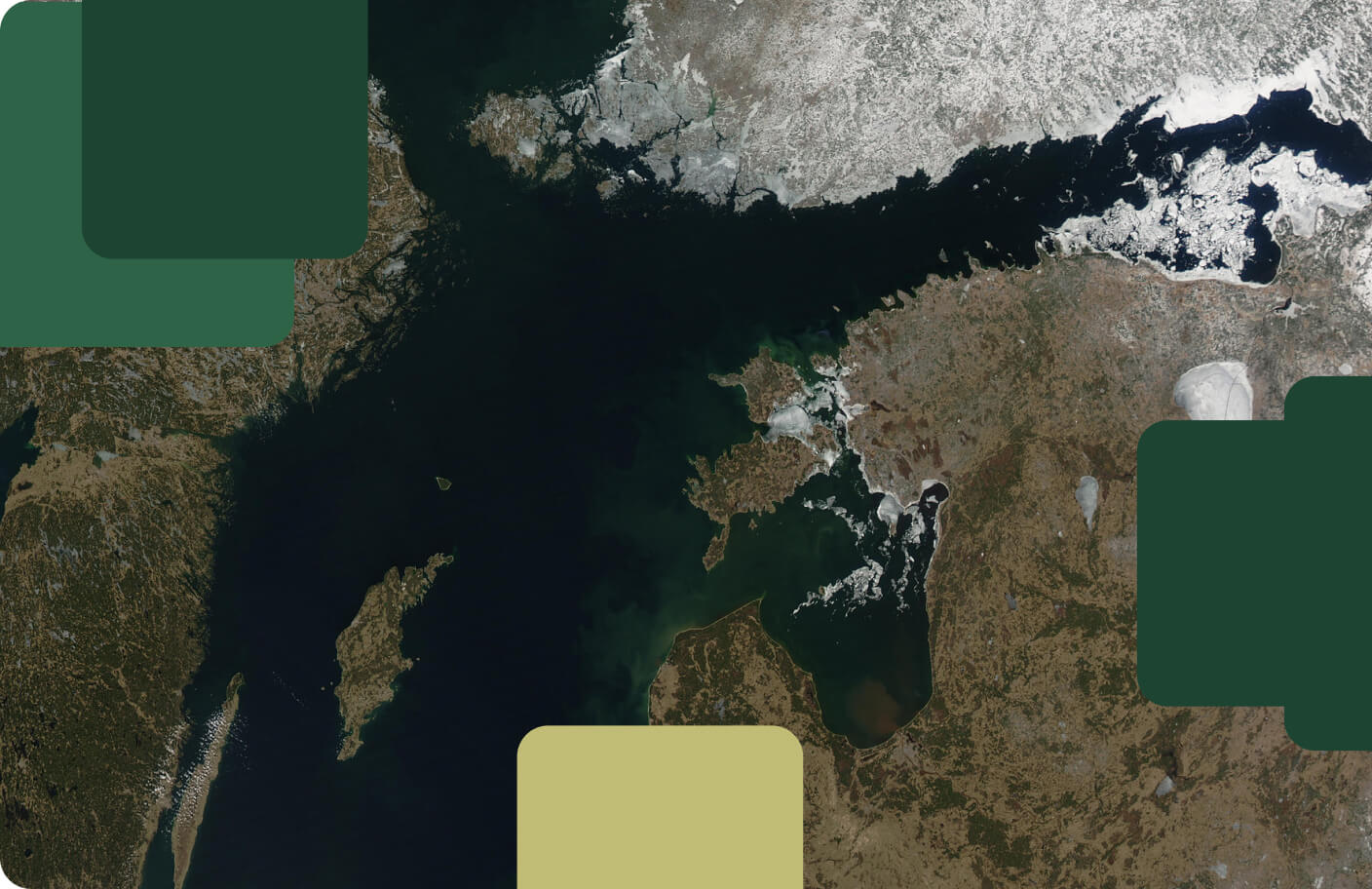

Thomas is a digital nomad. He became an e-resident and founded an Estonian company.

Thomas can manage his company entirely digitally from anywhere in the world, which is very cost-efficient and easy. Since he works in different countries and is not a permanent resident anywhere, he does not need to register a Permanent Establishment.